Trading may be a profitable method to create income and develop wealth, but it may also be a dangerous activity for novices. If you’re relatively unfamiliar to trading, the huge amount of information accessible may overwhelm you. We’re going to walk you throughout the fundamentals of trading while offering you with the information required to get started in this comprehensive guide to trade for beginners.

From Rags To Riches a complete guide

Step 1: Learn About the Different Kinds of Trading

The first step for beginners in trading is to grasp the various sorts of trading. Trading may be classified into numerous kinds, including:

Common Errors In Trading

• Stock trading is purchasing and selling stock in companies that are publicly traded.

• Forex trading: buying & selling currency in the form of pairs.

• Options trading: buying & selling from option contracts.

• Futures trading: buying & selling for futures contracts.

Each style of trade has its own distinct set of traits, benefits, and hazards. Before deciding which type of trading to pursue, it is critical to understand the various types of trading.

Become a pro In a investing

Step 2: Learn About the Markets

The next step in trading for beginners is to learn about the markets. The markets can be complex and dynamic, but with the right knowledge, you can navigate them successfully. Some key concepts to understand include:

Dark Side of Social Media

• Market volatility: the degree of variation in price over time

• Market liquidity: the ease with which assets can be bought and sold

• Market trends: the general direction of the market over time

• Economic indicators: market-influencing elements such as rates of interest and inflation.

You will be ready to make better educated trading selections if you comprehend the markets.

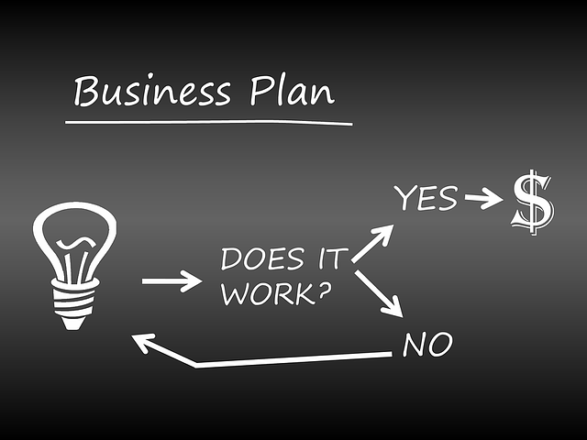

Step 3: Create a Trading Strategy

After you’ve decided on a trading style and studied the markets, your following step is to devise a trading strategy. A trading strategy is a collection of rules that control your trading activity. Your trading strategy should comprise the following elements:

Block Chain Technology

• Your trading goals

• Your trading strategy

• Your risk management techniques

• Your trading schedule

Your trading plan should align with your goals and be adaptable to changing market conditions.

Step 4: Choose a Broke

To start trading, you’ll need to choose a broker. A broker is a firm that facilitates the buying and selling of financial assets. When you are choose broker, keep in mind the following steps:

• Commission fees

• Trading platform

• Customer support

• Security measures

Research carefully for trading and choose a broker for your needs.

Step 5: Practice with a Demo Account

When you start trading with real money first you have to try with practice account. A demo account is a simulated trading environment that allows you to practice trading without risking real money. Use your demo account to test your trading plan and refine your strategy.

Step 6: Begin Trading Real Money

It’s time for you to begin trading with real money when you’ve practised using a trial account and have confidence in your trading abilities. Begin with a minimal trading volume and progressively raise it as you acquire expertise.Future of Wearable Technology

Step 6: Evaluate and Modify Your Trading Strategy

Finally, it is critical to review and change your trading strategy on a regular basis. The markets are continuously evolving, and your trading strategy must adapt to keep up. Review your trading strategy on a regular basis and make changes as needed.

Conclusion

In conclusion, Trading may be a difficult and demanding activity for novices, but with the appropriate information and setup, you may be successful. Understand the many forms of trading, learn how the markets, create a trading strategy, select a broker, practise using a demo account, begin trading with real money, and frequently evaluate and adapt your trading plan. You can attain your trading objectives with patience, tenacity, and discipline.

Frequently Asked Question’s (FAQ’s)

How does trading work?

Trading entails contributors, which includes buyers or traders, engaging inside the exchange of economic devices on various markets. Prices are stimulated by means of supply and call for dynamics.

What is the difference between stocks and bonds?

Stocks represent possession in a agency, whilst bonds are debt securities that investors lend to corporations or governments.

What is a trading strategy?

Strategies may consist of technical evaluation, fundamental analysis, or a aggregate of both.

How can I get started with trading?

To begin trading, educate yourself on monetary markets, expand a trading plan, pick out a dependable broking, and consider practising with a demo account earlier than using real cash.

Can anyone trade in financial markets?

In most cases, yes. However, it’s crucial to meet felony and age requirements, and people ought to have a very good knowledge of the risks worried earlier than taking part in buying and selling.

How do taxes work in trading?

Tax implications range by jurisdiction. Generally, profits from buying and selling are difficulty to capital gains tax. Traders should be aware about tax rules and keep accurate data in their transactions.

What is the minimum investment required to start trading?

Starting capital varies primarily based at the sort of trading and your preferred platform. While a few structures allow small investments, it’s advisable to begin with an amount you may manage to pay for to lose.

Do I need a background in finance to become a trader?

While a economic heritage can be useful, it’s no longer a strict requirement. Many a hit traders come from various backgrounds. What’s vital is a willingness to analyze and stay knowledgeable about market developments.

How do I manage the risks associated with trading?

Risk control is prime. Set forestall-loss orders, diversify your portfolio, and handiest make investments what you could manage to pay for to lose. Education on threat management techniques is critical for any trader.

Are there tax implications for trading income?

Yes, buying and selling income is challenge to taxation.

Can I trade part-time while working a full-time job?

Yes, many traders stability trading with full-time employment. Effective time management is essential. Ensure you’ve got a nicely-described trading plan and set practical goals given a while constraints.